Filing income tax in Malaysia

So, you’ve joined the wonderful world of adulting and now hold down a 9-to-5 job. While extended freedom comes with that monthly paycheck in the bag, there are also additional responsibilities to mind, such as bills, budgeting, and yes, the dreaded T word: taxes.

First things first, deep breaths. Taxes may be certain, but you don’t have to lose your sanity over them. Whether you are a first jobber or a taxpayer who needs a good refresher, this guide will help you fill up your income tax in Malaysia before the doom of deadlines.

Table of Contents

What is an income tax?

In Malaysia, income tax is a yearly obligation for anyone who draws a salary. In the simplest of terms, you need to report your income to the Inland Revenue Board of Malaysia (IRBM), also locally known as Lembaga Hasil Dalam Negeri (LHDN). Think of it as telling the government, “Hey, here’s what I earned last year”.

Who needs to file income taxes in Malaysia?

Whether you have a MyKad in your name or a non-resident who’s made bank while in the country, if you’re earning anything and on a payroll, you need to file your income taxes.

Image credit: Kelly Sikkema via Unsplash

As for when you’re taxable by law, there are three basic criteria:

- Your annual income is more than RM37,333 in the preceding year and has a Monthly Tax Deduction (MTD) after Employees Provident Fund (EPF), or Kumpulan Wang Simpanan Pekerja (KWSP), deductions. This works out to be around RM3,111 in monthly earnings.

- You are self-employed and have received an income that exceeds RM37,333 after EPF deductions.

- You are a non-resident who has earned income from work performed in Malaysia.

When do I need to file my income tax?

Malaysia operates on a self-assessment system, which means you’re in charge of working out how much you owe, not the government. You’ve got to calculate your chargeable income, figure out your tax payable, and pay off any leftover balance yourself. Once you’ve submitted your tax return, it’s officially viewed as your notice of assessment.

As for datelines, this varies each year, but typically begin in March. In 2025, you’ll need to file your income tax for the Year of Assessment (YA) 2024 by:

- 30th April 2025: Form BE, BT (Resident individuals without business income)

- 30th June 2025: Form B (Resident individuals with business income)

How do I file my income tax?

You can skip the paper piles and manual calculations by going digital with LHDN’s electronic filing system, or e-Filing, on LHDN’s MyTax portal or mobile app. Some might recall the portal being called ezHASiL. Beginning with YA 2024, all taxpayers must submit their Income Tax Return Forms (ITRF) online – manual applications are no longer accepted.

What is the tax rate for 2024?

We broke down the income tax rate for the assessment years 2023, 2024, and 2025, as shared by LHDN:

| Chargeable Income (RM) | Tax Rate (%) | Calculation (RM) | Tax Amount (RM) |

|---|---|---|---|

| 0 – 5,000 | 0 | On the first 5,000 | 0 |

| 5,001 – 20,000 | 1 | On the first 5,000 Next 15,000 |

0 150 |

| 20,001 – 35,000 | 3 | On the first 20,000 Next 15,000 |

150 450 |

| 35,001 – 50,000 | 6 | On the first 35,000 Next 15,000 |

600 900 |

| 50,001 – 70,000 | 11 | On the first 50,000 Next 20,000 |

1,500 2,200 |

| 70,001 – 100,000 | 19 | On the first 70,000 Next 30,000 |

3,700 5,700 |

| 100,001 – 400,000 | 25 | On the first 100,000 Next 300,000 |

9,400 75,000 |

| 400,001 – 600,000 | 26 | On the first 400,000 Next 200,000 |

84,400 52,000 |

| 600,001 – 2,000,000 | 28 | On the first 600,000 Next 1,400,000 |

136,400 392,000 |

| Above 2,000,000 | 30 | On the first 2,000,000 Next ringgit |

528,400 |

How do I register as a taxpayer?

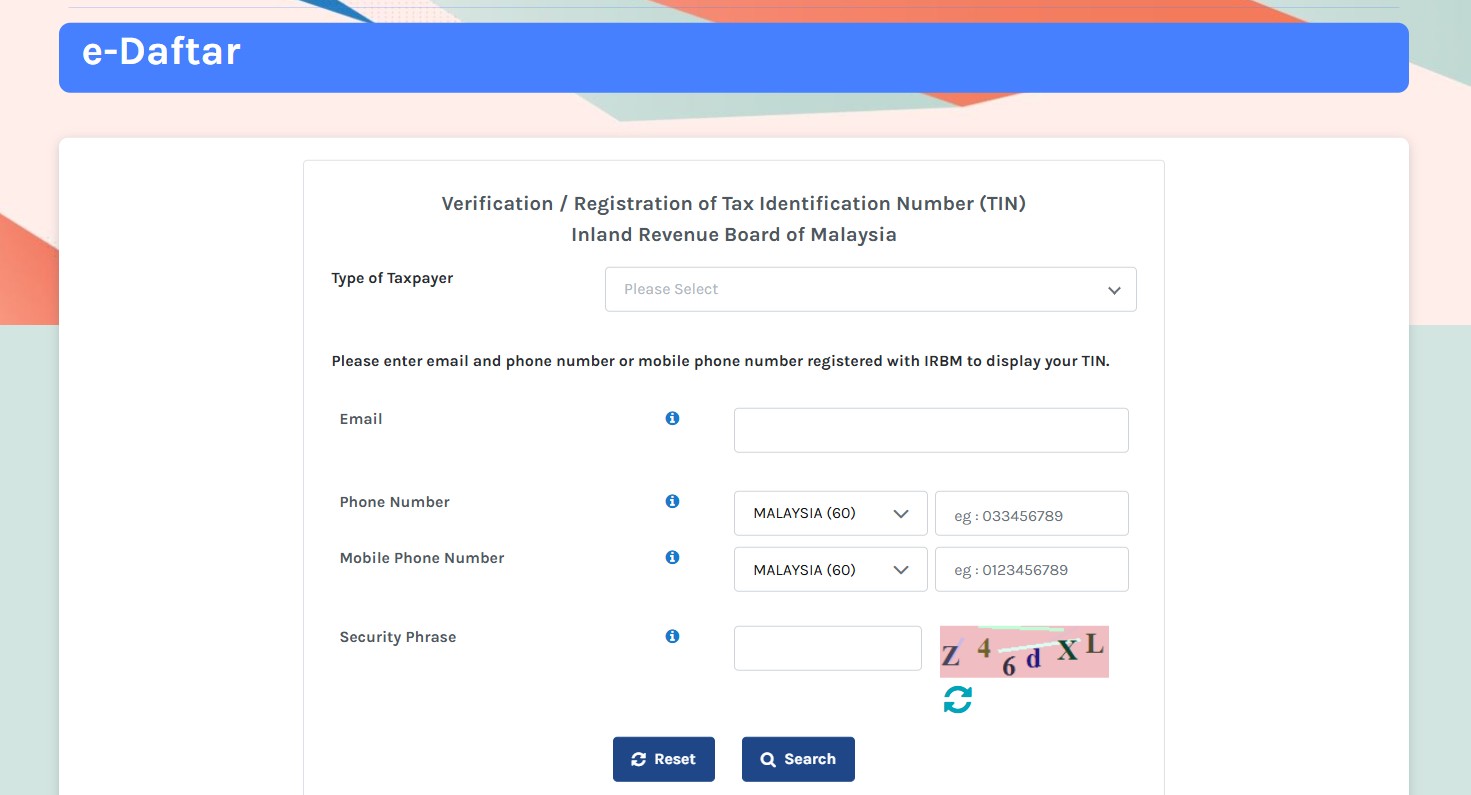

If you’re a first-time taxpayer, you’ll need to obtain a tax identification number (TIN) and a digital certificate to file for your taxes. According to LHDN’s website, there are two easy ways to get these online – this process has been mandated since 2023.

To verify and register for TIN

- Head to the e-Daftar portal

- Fill in your details, including name, identification number, and email address

- Upload a copy of your identity document

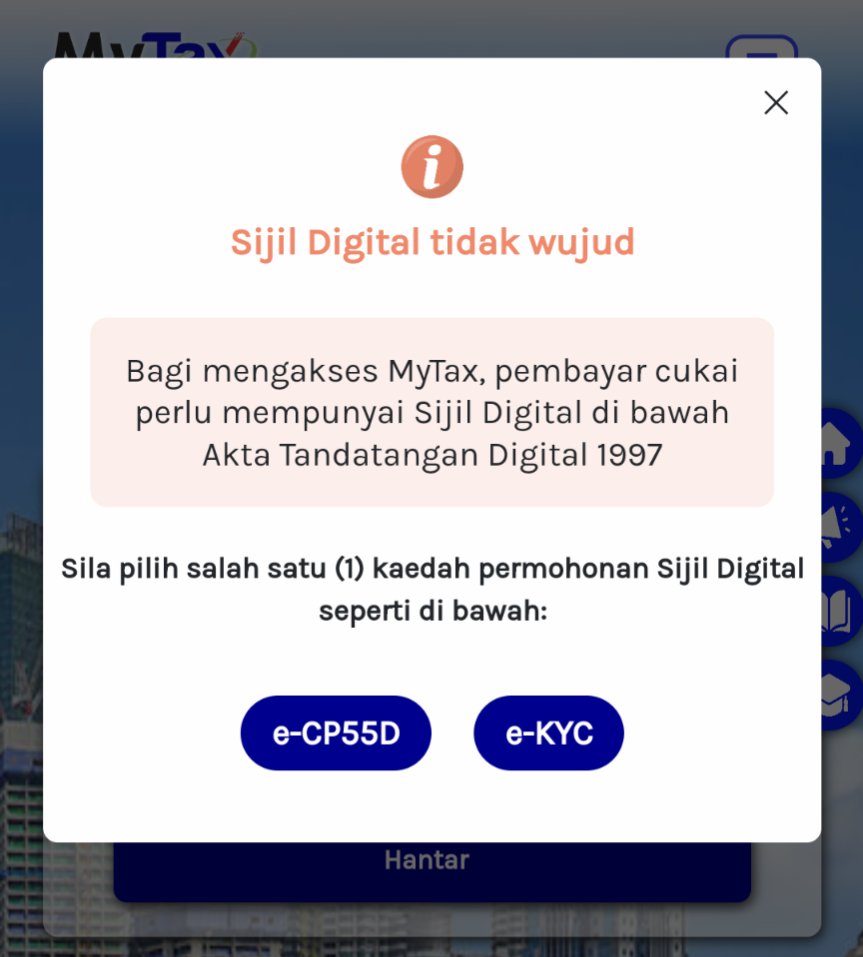

To apply for a digital certificate

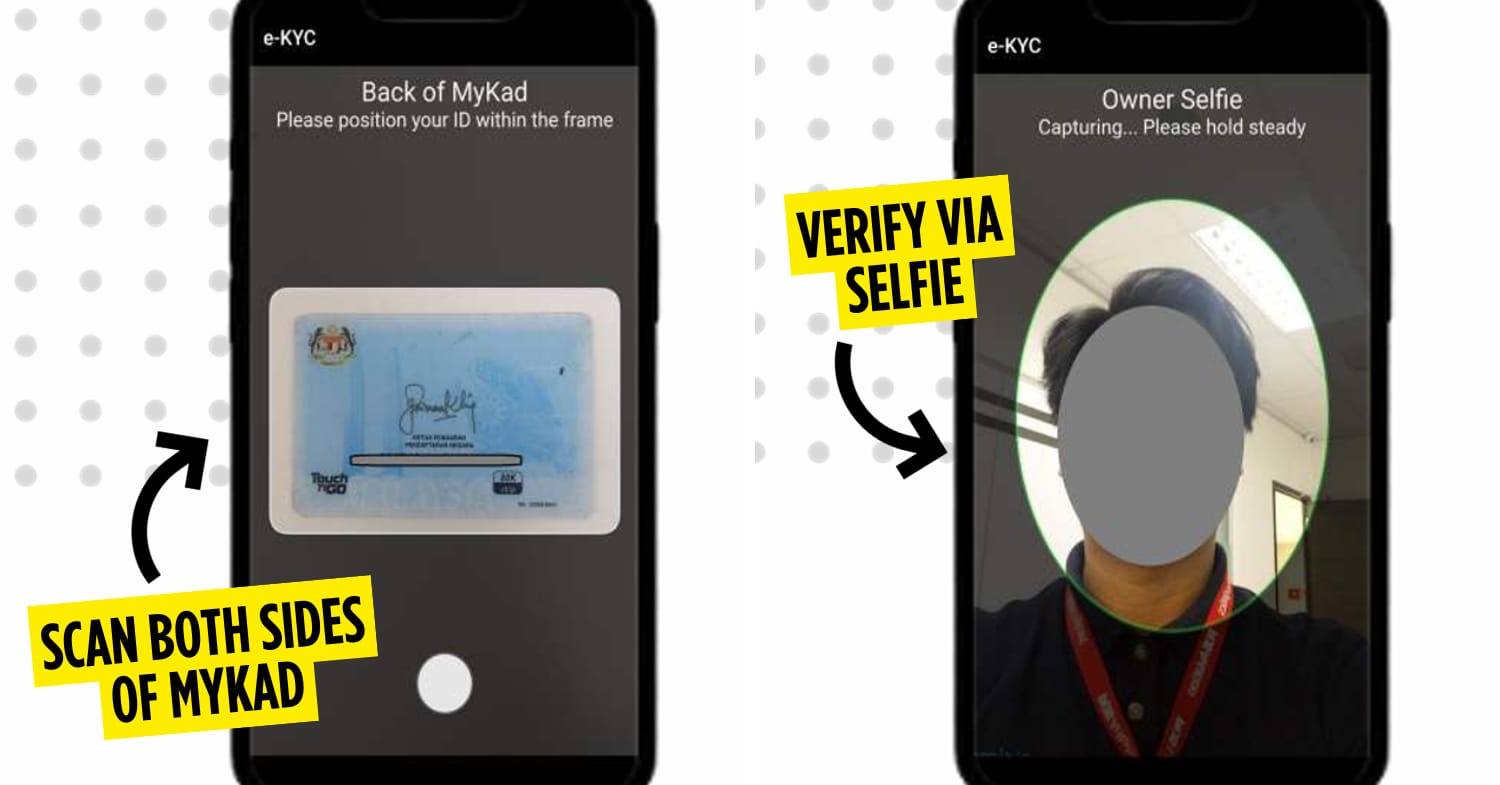

You’ll need to have a digital certificate if you’re a first-time taxpayer. You can choose to register with e-KYC, which lets you verify your identity by matching the photo on your provided MyKad or passport with a selfie on LHDN’s MyTax mobile app.

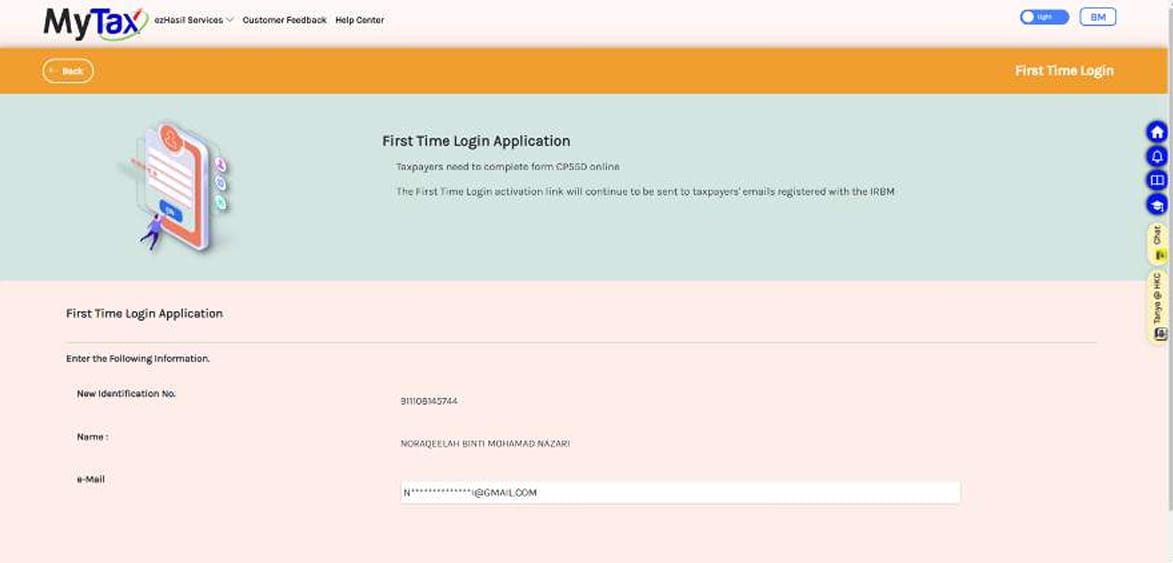

Otherwise, there’s the e-CP55D option that can be accessed from the MyTax portal, which has a lengthier but easy-to-follow process:

- Verify or update your registered email address. Ensure you have access to this.

- Confirm your identification number, name, and email. Click “Send” if it’s all correct.

- An activation link will be sent your registered email. Click the provided link in your email inbox to activate your digital certificate. The link will be valid for 2 days.

- Log in to your account on MyTax with your identification number and create a password and security phrase.

- Agree to terms and conditions, and click “Submit”.

- If successful, a pop-up will tell you that your digital certificate was created successfully.

Image credit: Hasil

Steps to file your income tax

Step 1: Register as a taxpayer

If this is your first time logging into MyTax, make sure you’re already registered as a taxpayer with LHDN, and have a TIN and digital certificate.

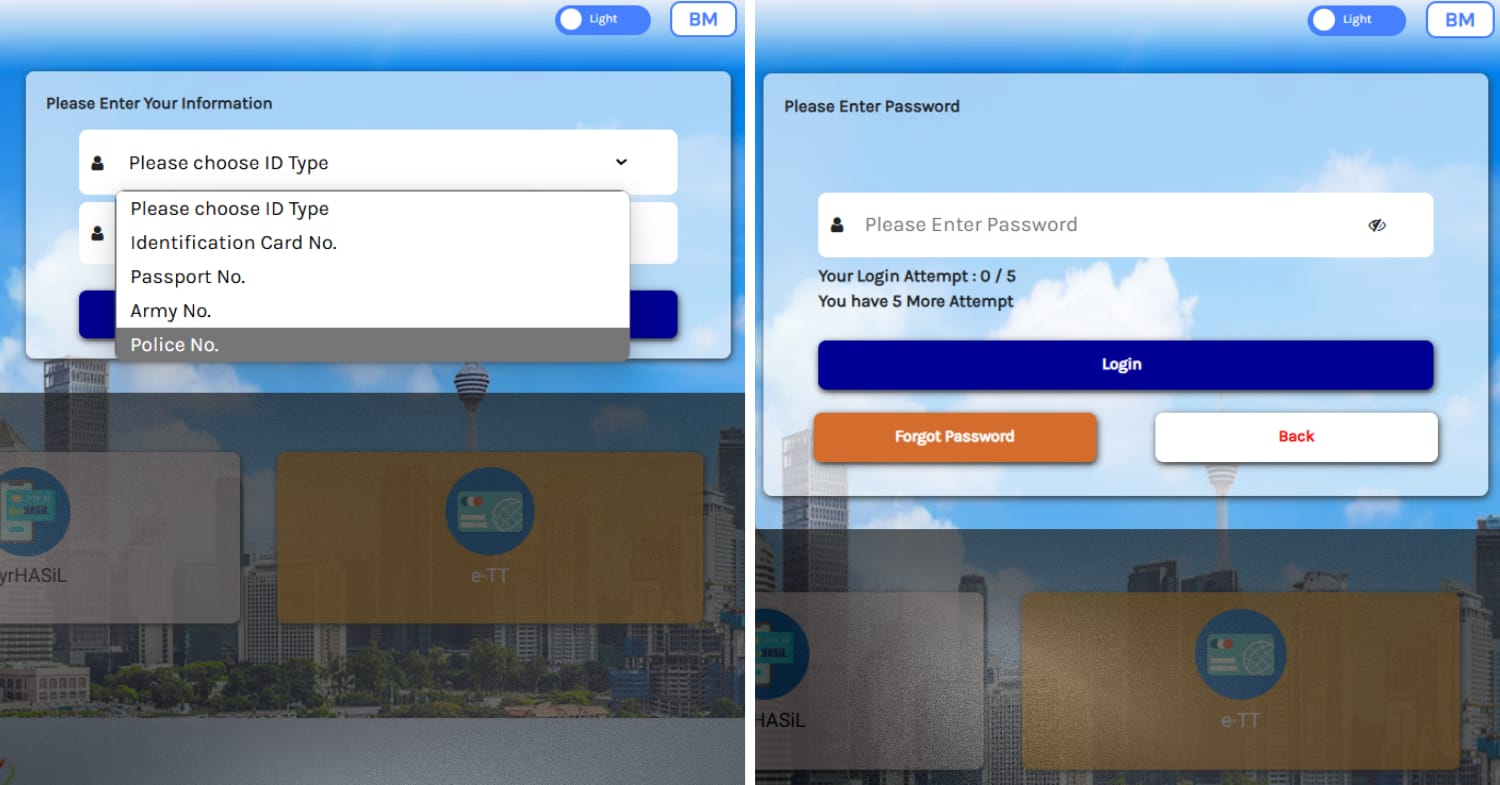

Step 2: Log in to e-Filing

Head over to MyTax and log in with your credentials. There will be a drop-down menu where you have to select your identification type: identification card, army, police, or passport number.

Next, key in your password, click “Login”, and confirm your security phrase. If you forget your password, you can hit “Forget Password”. There are just five password attempts – any tries beyond these and your account will be blocked for 10 minutes.

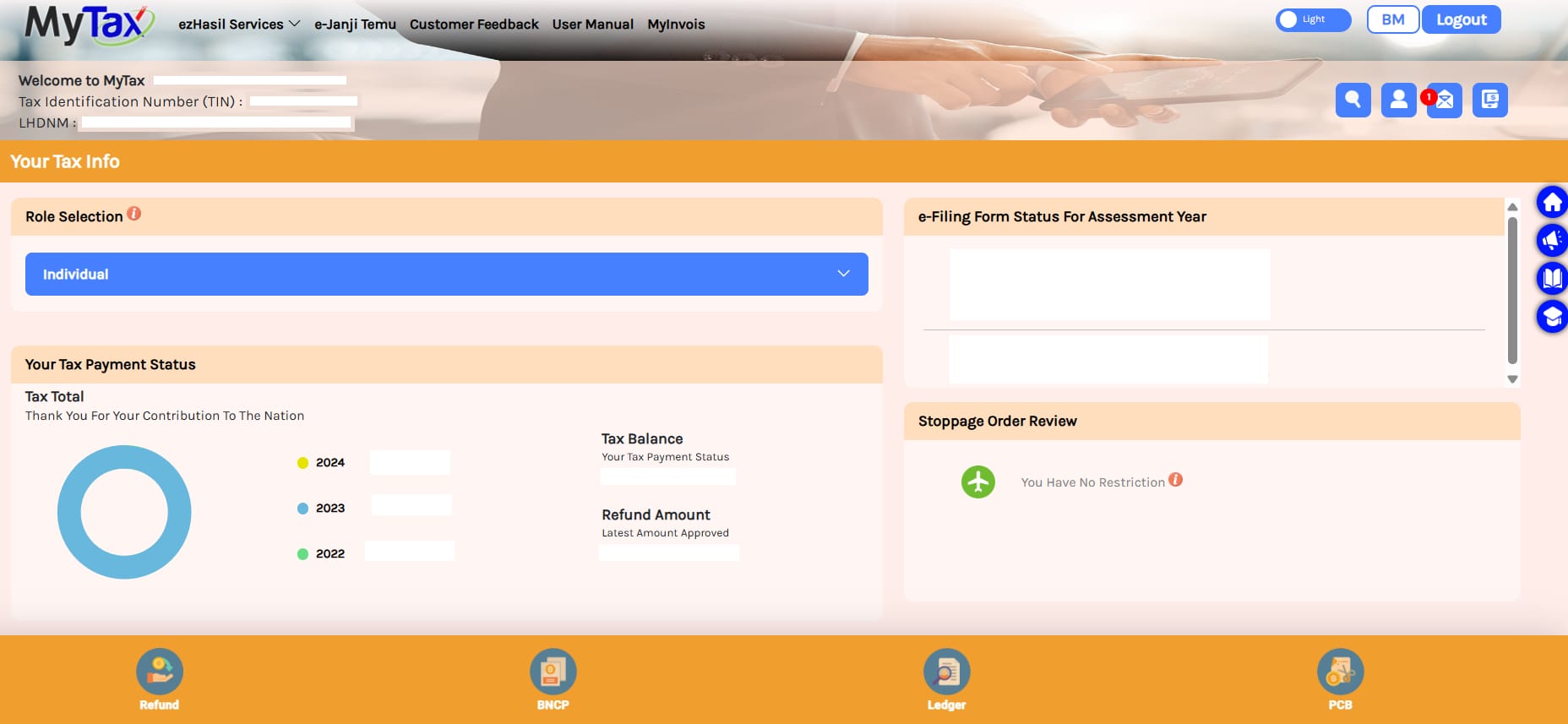

You’ll be taken to a user dashboard that shows everything related to income tax and you at a glance, including your e-Filing form status, tax payment status, and any restrictions.

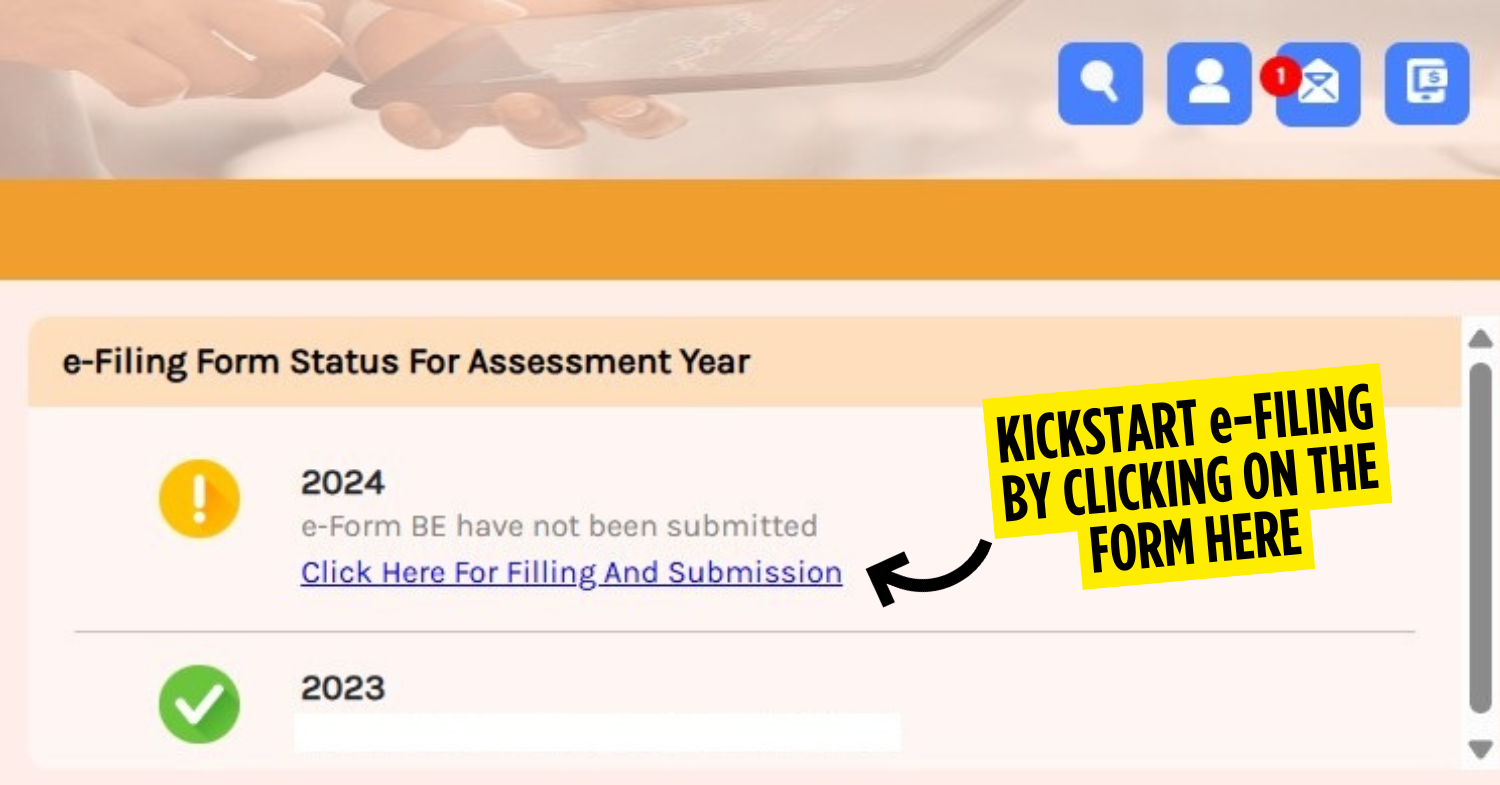

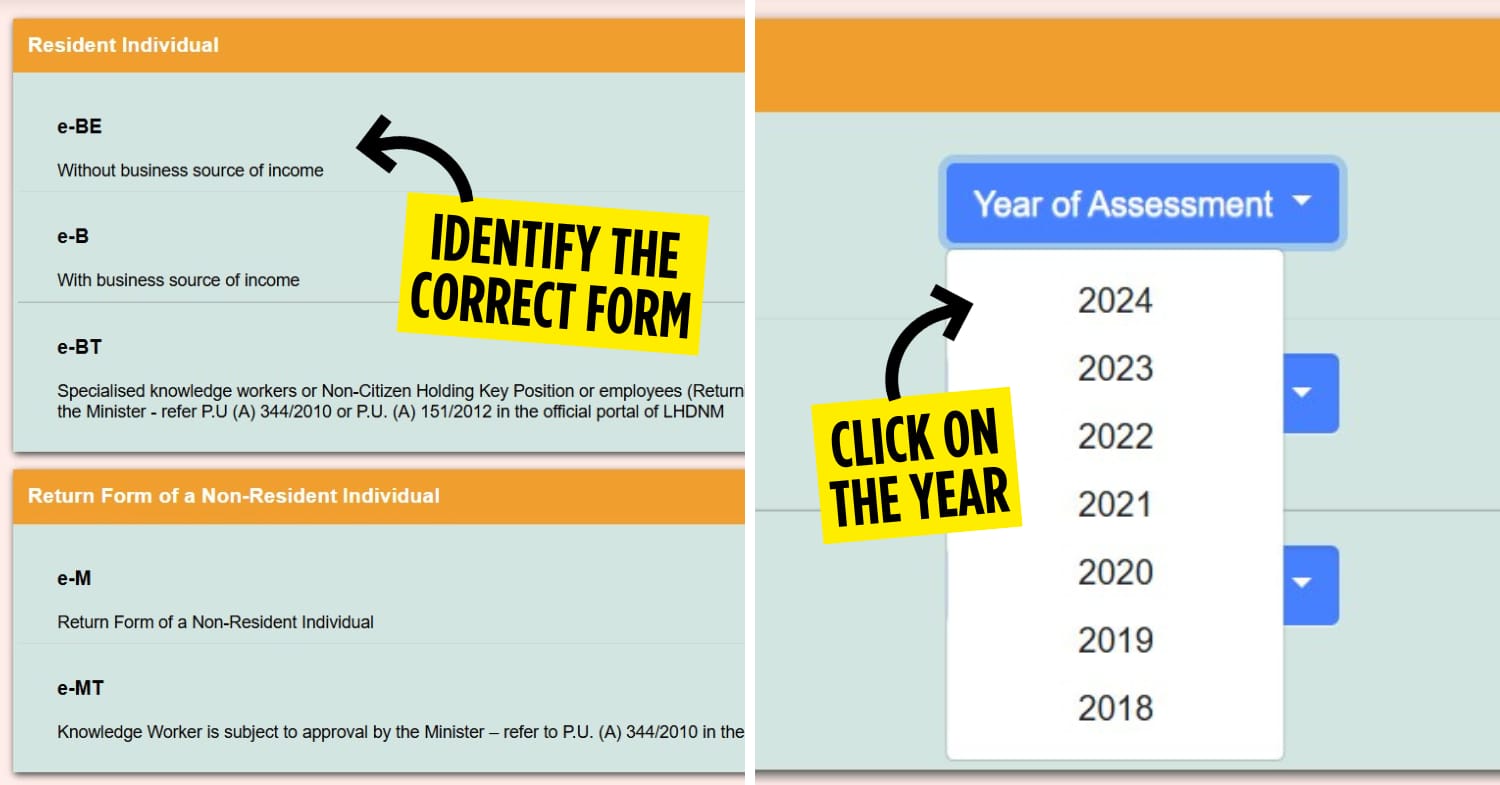

Step 3: Choose the correct form

After you’ve logged into your account, locate the link that will direct you to your e-Filing form for the assessment year. If your ITRF is not completed, it will be marked with an exclamation point symbol next to it for action.

To begin filing your income tax, select the tax form that accurately reflects your income type and the correct Year of Assessment from a drop-down list next to it. Breakdowns of the Resident Individual forms include:

- e-BE – For individuals with no business income

- e-B – For those with business income

- e-BT – For residents with foreign income and qualified tax exemptions

Once you’re in the e-Form section, you’ll spot a buffet of tax forms waiting for you to pick one. If you’re a regular salaried individual and not running a business, go ahead and select Resident Individual (e-BE) from the list.

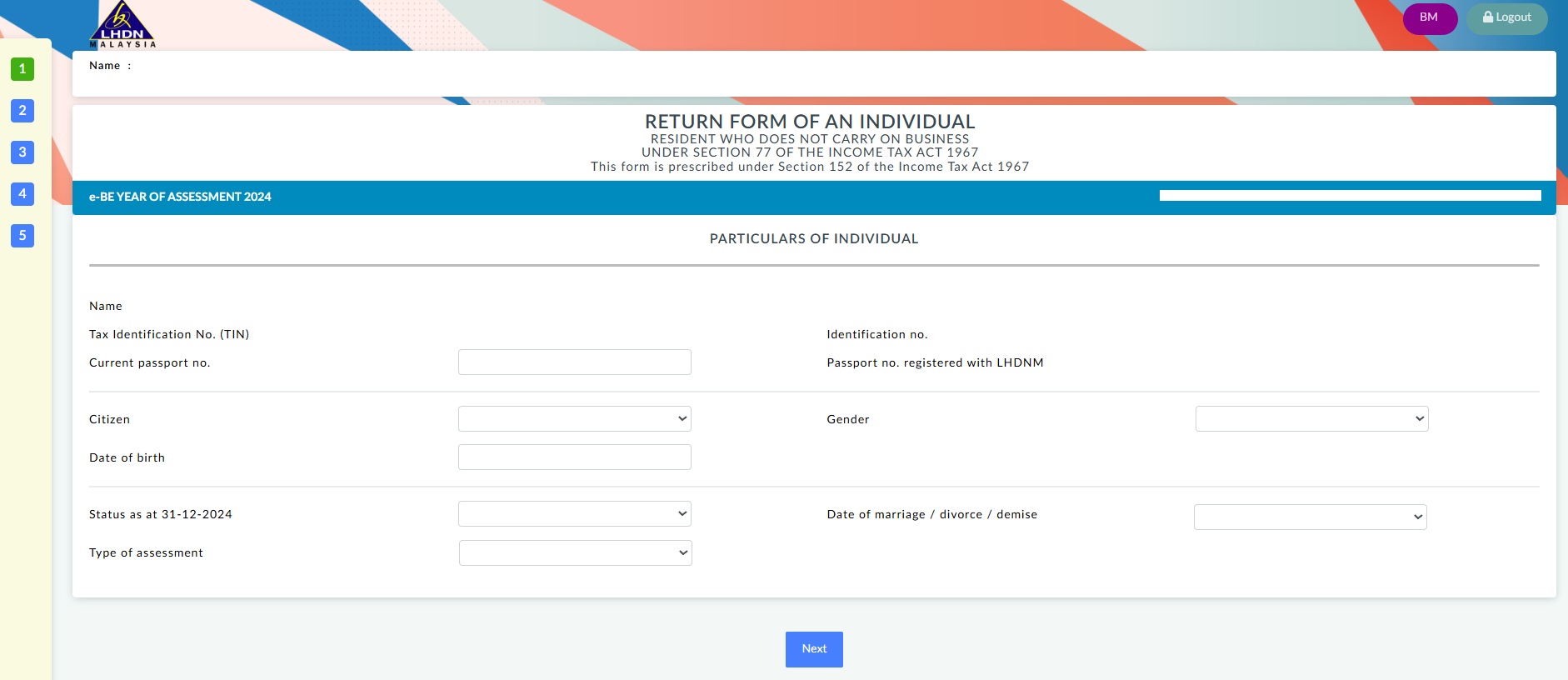

Step 4: Fill in your personal details

The first step in the e-Filing process is simple enough. Here, you’ll need to fill in all your personal information that hasn’t already been keyed in automatically, which are usually your identification number, full name, and TIN.

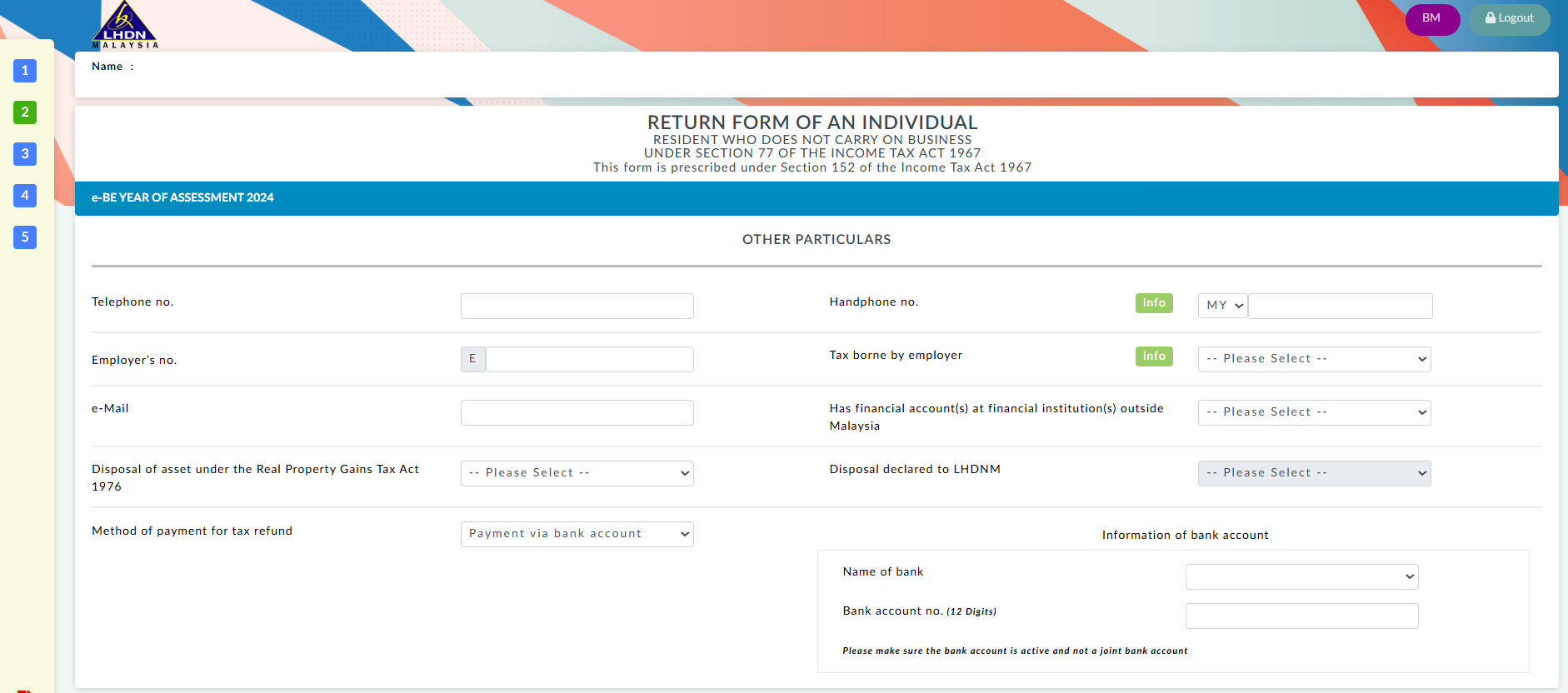

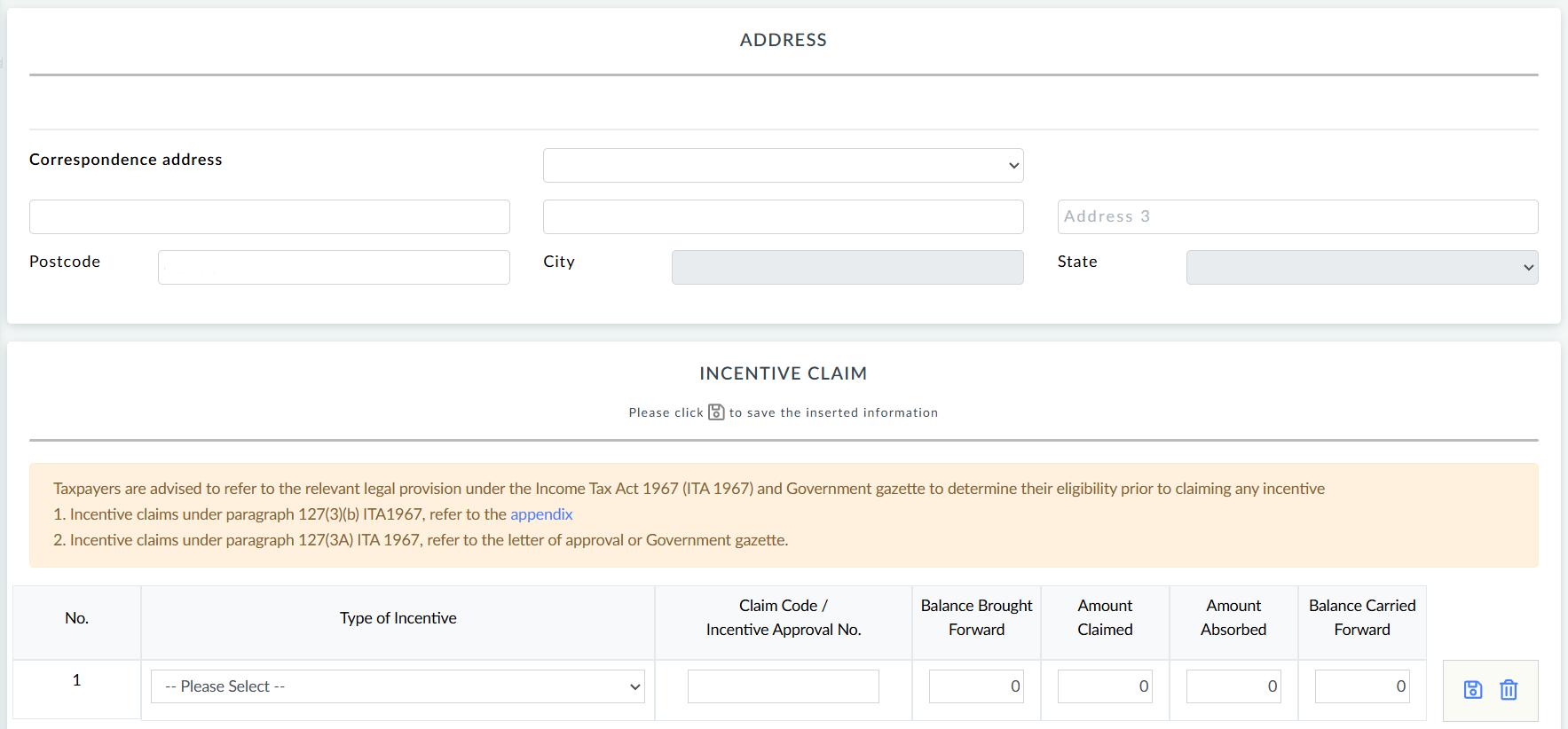

Step 5: Fill in your other details

Next, you’ll need to have your EA Form in hand, which is provided by your company’s HR department. The form will have all the necessary details of your employer to fill in the Employer’s No. on this page and other information on the next page.

Other details to look at on this tab include:

- Your email, telephone, handphone number, and address

- Declaration of overseas financial accounts

- Your preferred method of payment for the tax refund and its details: bank transfer or DuitNow

You’ll also see a section called Incentive Claim at the bottom of the page. Unless you’ve got a government gazette or a minister’s approval letter granting you some special tax exemption under the Income Tax Act 1976, just leave this space unfilled.

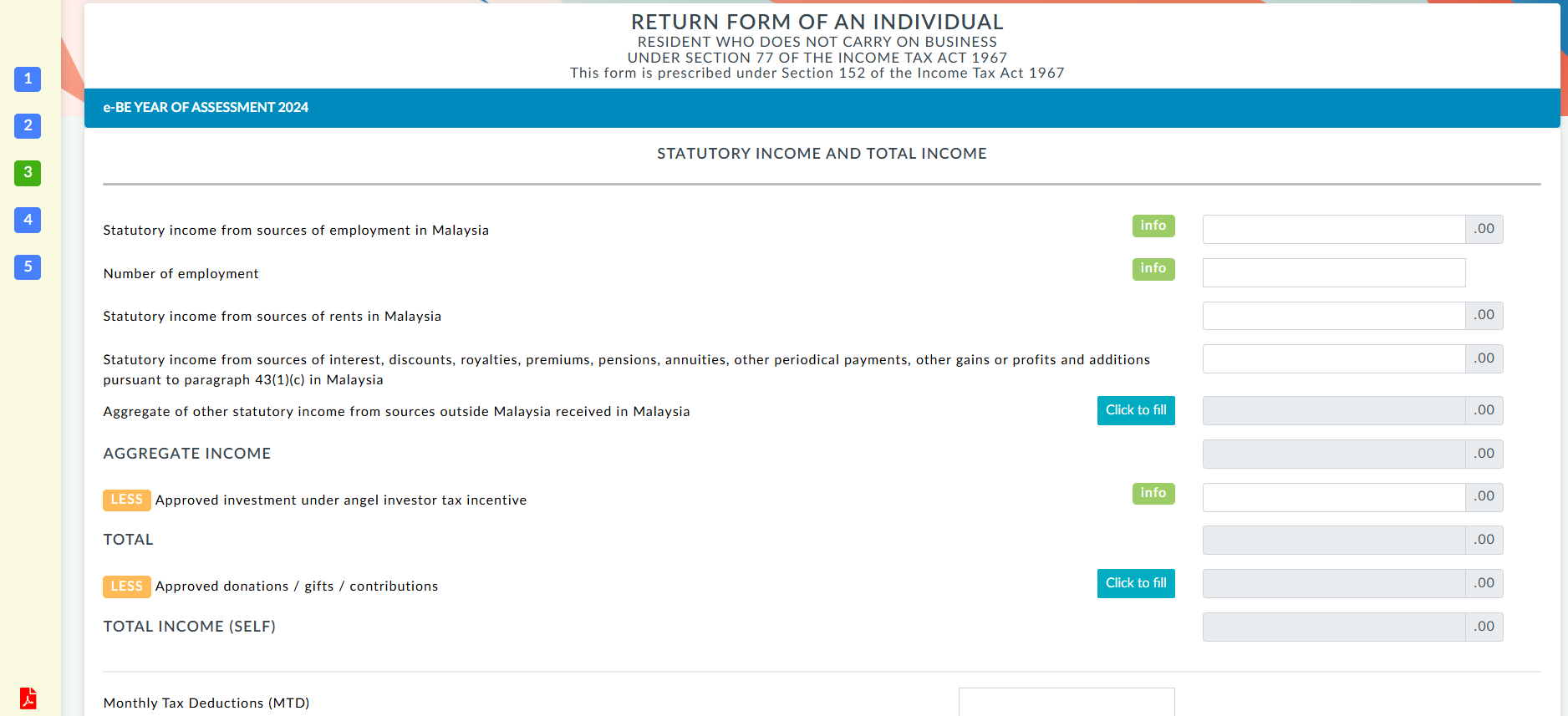

Step 6: Declare your statutory income and total income

Your EA Form will be most relevant when declaring your Statutory Income and Total Income as it contains important information needed to fill in this section, including main ones for first jobbers like:

- Statutory income from sources of employment in Malaysia, or your total income for the year

- Number of employment

If you have income from other sources, like rents in Malaysia, you’ll have to declare it here too.

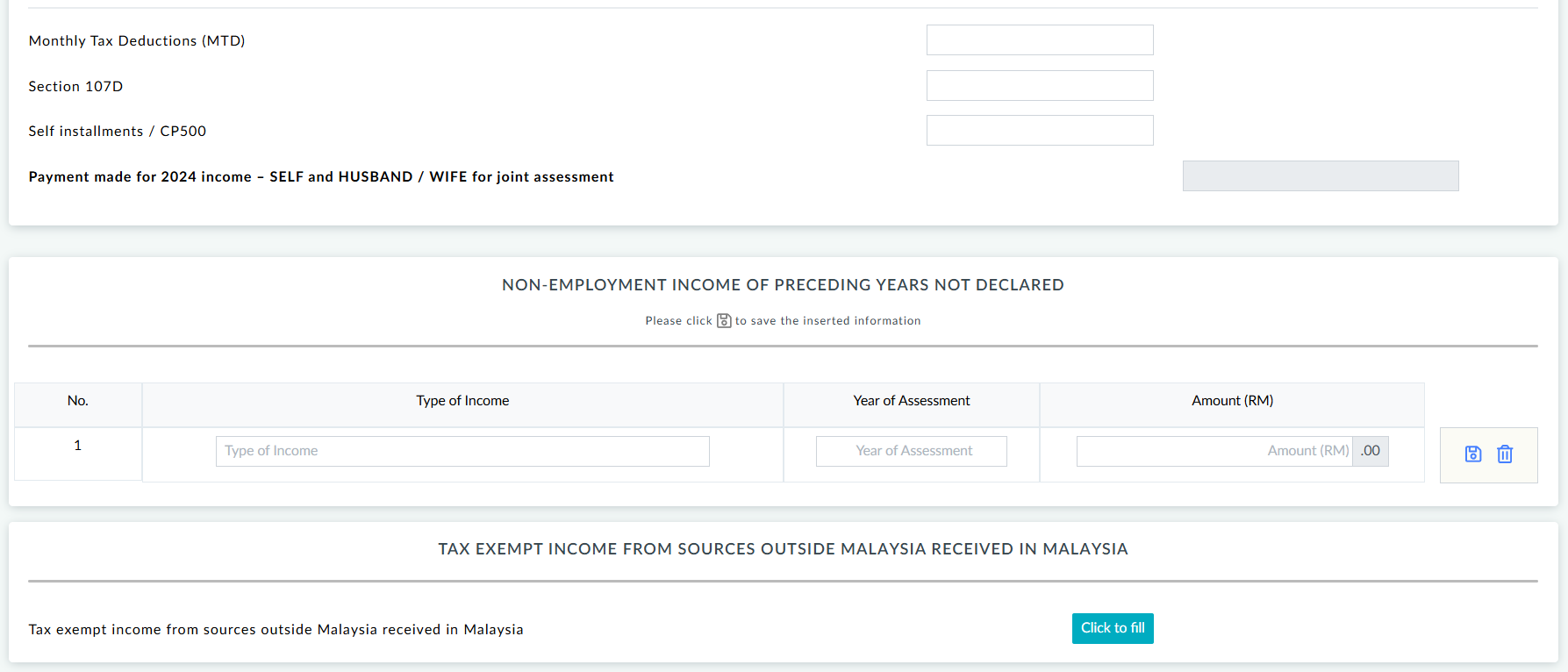

Next up is your MTD, or Potongan Cukai Bulanan (PCB). Make sure the figures match up with the numbers printed on your EA form. And, if you forgot to declare any income from previous years, now’s your chance to come clean under Non-Employment Income of Preceding Years Not Declared.

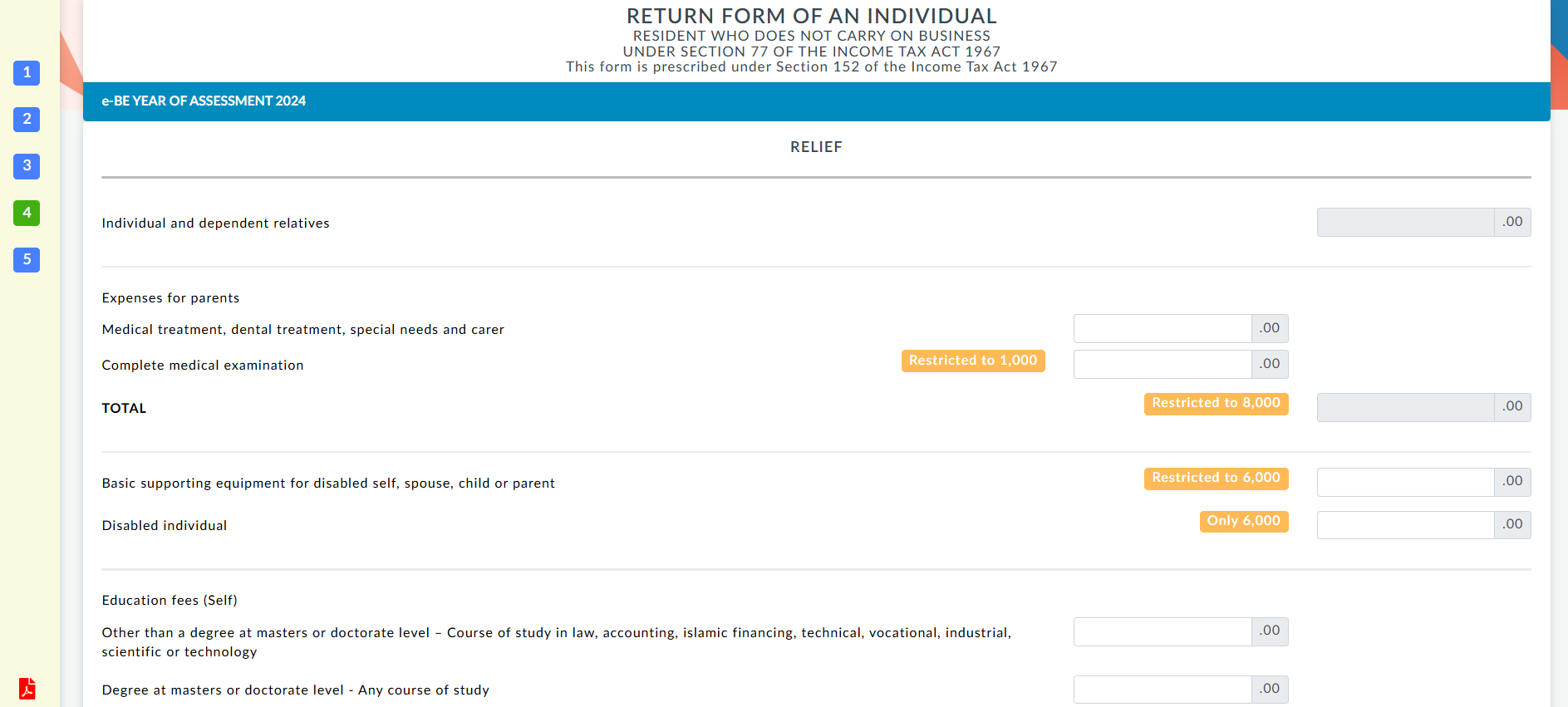

Step 7: Claim your tax reliefs

Tax reliefs are the government’s way of saying, “Thanks for adulting responsibly”. This section is where you can potentially save money. List any applicable tax reliefs that cover purchases or contributions made during the assessment year:

- Lifestyle purchases, which covers books, gadgets, and gym memberships

- Medical expenses, including serious diseases, fertility treatment, vaccination, Covid-19 detection test, mental health consultation, and dental examination and treatment

- EPF and life insurance

- Electric vehicle equipment or subscription for personal use

- Parent’s medical expenses, including nursing home fees

- Education, private retirement scheme (PRS), Social Security Organization (SOCSO), and others

A handy guide to tax relief from LHDN.

A handy guide to tax relief from LHDN.

Image credit: LHDNM via Facebook

Once you’ve keyed in all your deductions and rebates, the system does the math for you. No calculators are needed — it’ll work out exactly how much tax you owe or don’t owe.

Step 8: Sign and submit

Look for the Total Tax Charged section in the final step of your e-filing — that’s the big number. Then, it’ll subtract what’s already been paid through your monthly salary deductions, or MTD/PCB. If you’ve overpaid, congrats – you’re due a refund. But if you’ve underpaid, you’ll see the amount you still need to settle under the Balance of Tax Payable.

The full tax payable can be paid by monthly installments. An appeal letter can be submitted to the HASiL office that usually handles your tax files, along with supporting documents like income statements, bank statements, and estimated monthly expenses. Tax payments will require a TIN or a bill number.

Income pax payments can be made via online banking (FPX), over the counter at post offices and banks, at ATMs, and more.

Finally, just confirm that everything you’ve entered is accurate, then hit Sign & Submit to electronically lock it all in. Make sure to download or print the acknowledgment slip for your records.

What if I don’t file my income tax?

If, for any reason, you do not submit your income tax return before the deadline, there will be penalties incurred up to 15% additional tax based on the amount owed. In the worst-case scenario, failure to file or pay your tax may lead to court action and fines under the Income Tax Act.

Step-by-step guide to fill up your income tax in Malaysia

Filing your income tax in Malaysia isn’t exactly a party, but it’s doable with the right guide to help you do so before the deadline. So go ahead and complete your income tax application, and once it’s all done, reward yourself with some teh tarik and kuih – you deserve it.

For more reads, check out:

Cover image adapted from: TheSmartLocal Singapore, Kelly Sikkema via Unsplash