Lured into a crypto scam and the lessons learned

They say you never truly understand a pivotal moment in your life until after it happens to you. And when it does, it feels as if the ground beneath you is cracking, leaving you teetering on the edge of disbelief. That’s exactly how I felt upon realising I had been scammed.

Reality can feel cruel at times – especially when you come to terms with the fact that you’ve just transferred a significant portion of your hard-earned money to a conniving stranger who’s probably sipping cocktails on a sun-drenched beach without a care in the world.

This is my story of being scammed and all the red flags I shouldn’t have ignored.

It started with a message on Telegram

My unfortunate experience kicked off on a seemingly regular Monday morning.

I was going through my usual pre-work routine when I noticed a message notification from an unknown group chat on my Telegram app. It was flooded with proof of payment photos from other group members.

Image (for illustration purposes only) credit: Lindsey LaMont via Unsplash

Image (for illustration purposes only) credit: Lindsey LaMont via Unsplash

The out-of-the-blue nature of this group reaching out to me should have set off alarm bells, but for some reason, I put my usual caution aside. Sure, schemes like these tend to come off as a bit dodgy, but curiosity got the better of me.

In this fast-paced digital world and knowing the side hustle culture in Malaysia, I convinced myself that this was probably just one of the many modern ways to earn a little extra cash online.

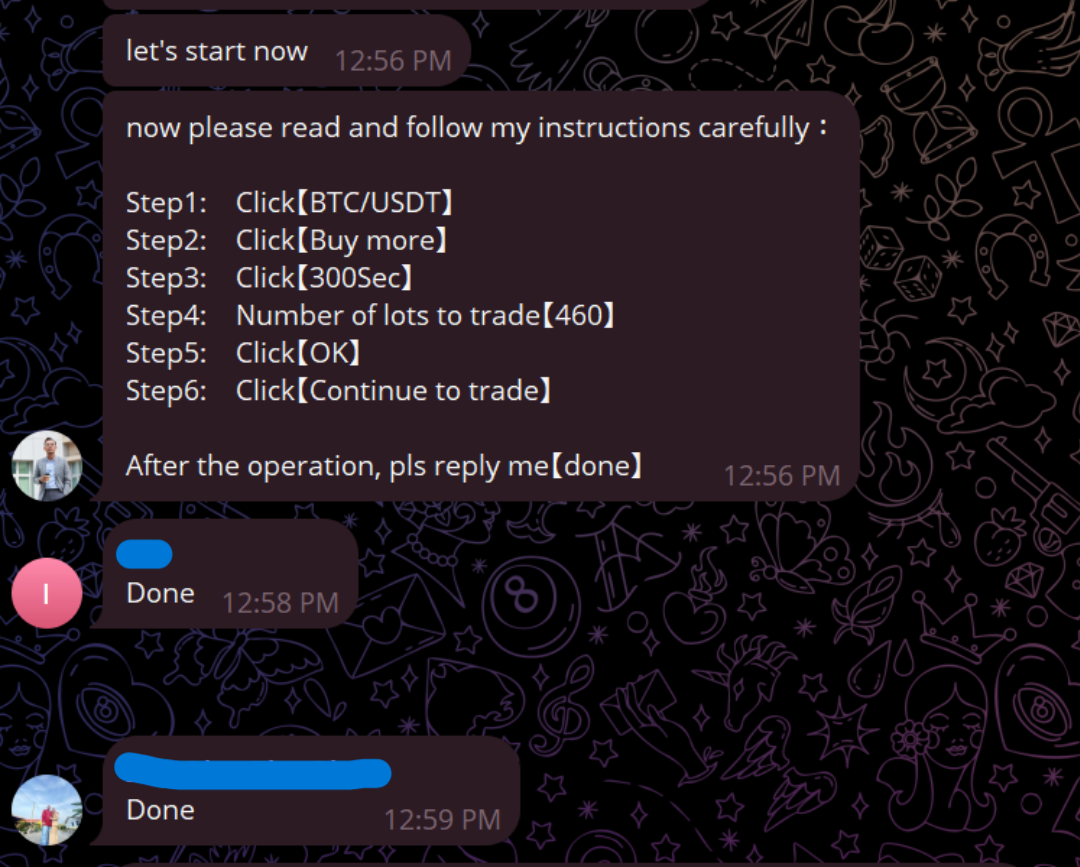

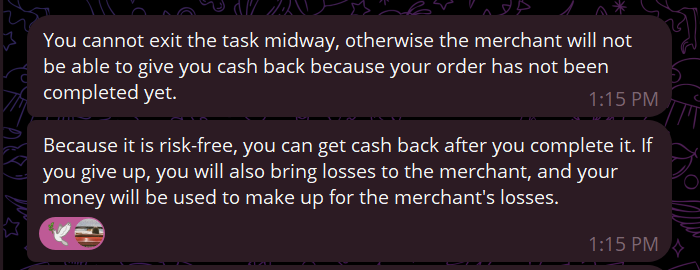

A series of ‘tasks’ that the Receptionist sent to members in the group chat.

A “receptionist” was in charge of the group chat and would assign jobs to group members. The job involved completing 14 tasks, with the first 10 appearing simple and straightforward enough to lure anyone in: subscribe to YouTube channels, submit screenshots as proof of completion, and then receive payments after the Receptionist verified the submissions.

Soon, money would trickle into your bank account, with amounts varying between RM18-30. The whole gig felt harmless enough – a bit boring even – and I didn’t encounter anything to raise serious alarm bells. But the seemingly innocent setup took a turn for the worse when I approached the final few tasks.

Out of nowhere, I was asked to transfer money.

The Kraken awoke and roped me into a web of lies

The kids all know the saying, never take candy from strangers. For us grown-ups, it’s never transfer money to someone that you don’t know. A simple rule that, in hindsight, I should’ve followed. But I was already tangled in their carefully crafted web of deceit when the first glaring red flag reared its ugly head.

The Receptionist instructed me to wire RM80 to a bank account number. I was told it would be used to set up a crypto account with what they claimed to be Kraken, a known US-based cryptocurrency trading site, where the money would be deposited. As it appeared to be legit enough at that point, I went ahead and transferred the cash.

Mind you, I’m completely clueless about cryptocurrency trading.

I was assigned a “Tutor” to walk me through the account setup and trading process. I basically had to continue completing a series of tasks, vaguely similar to the ones I had already been doing.

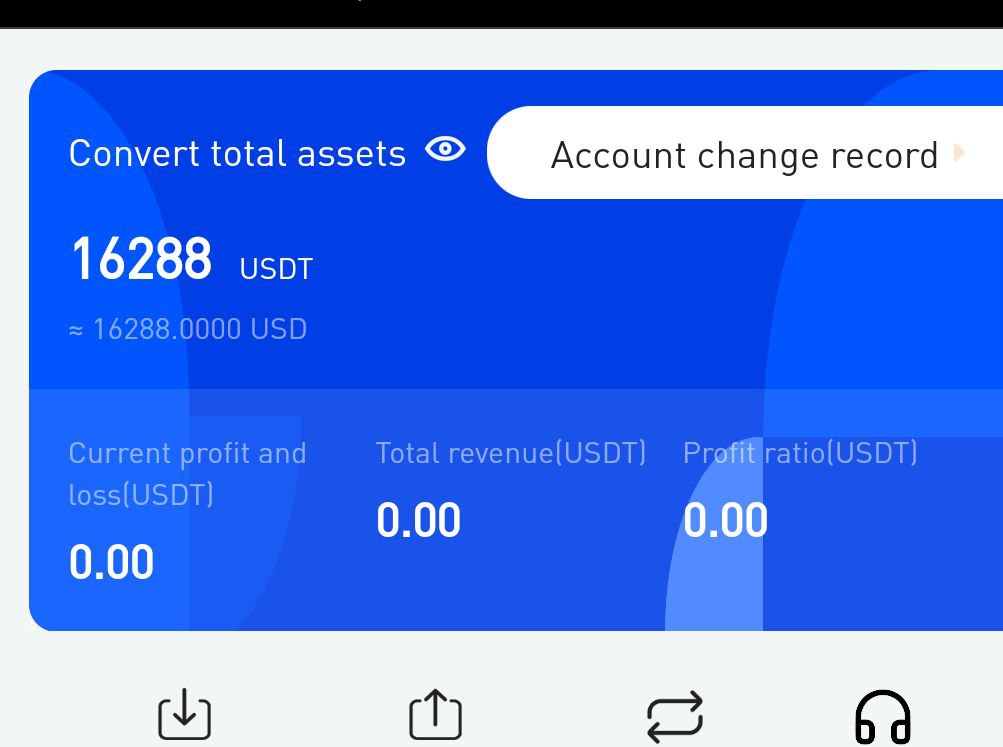

The supposed high returns in USD in my Kraken account.

The supposed high returns in USD in my Kraken account.

The only real difference between this scheme of lies and the previous ‘assignments’ on Telegram was the increased amount of cash involved. To my surprise, my Kraken account showed money in USD that matched the amounts I’d deposited, growing with each completed task.

This was the second red flag – receiving such large sums at a quick rate. Nevertheless, I followed their instructions to the letter and placed my trust in the Tutor, convinced they were here to help me.

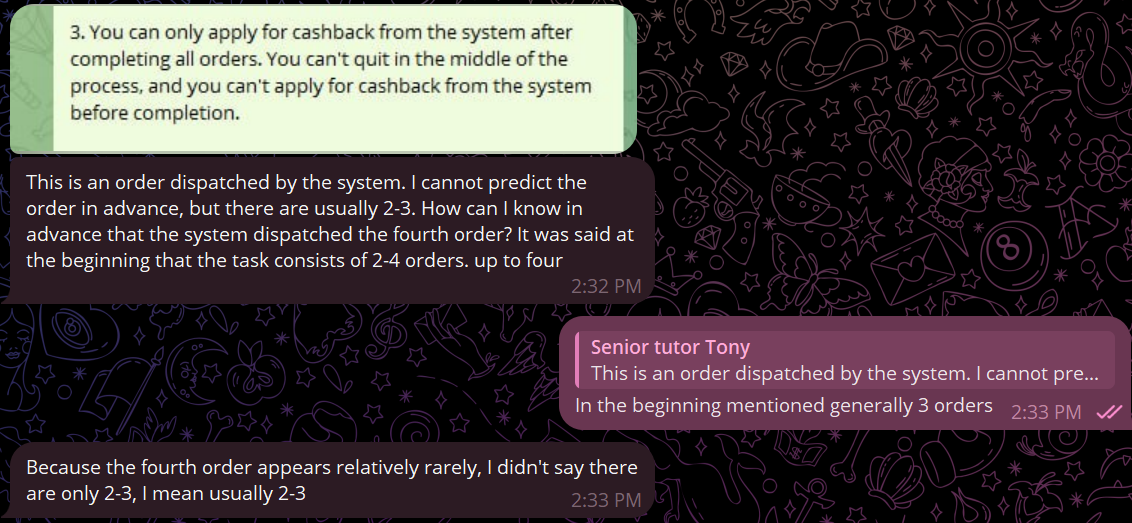

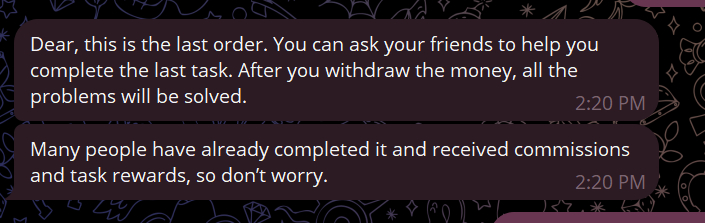

The scammer defending the additional tasks.

But then I received a message from the Tutor, claiming that the system had added an extra task for me to complete which was never mentioned before and required depositing another sum of money. Frustration crept in, as I thought I had completed my required amount of tasks, and I began to question their so-called “terms”.

I would later learn that this was another manipulation tactic meant to keep victims hooked until the very end.

At this point, everything felt undeniably wrong – a third red flag – but one that’s not too late to let register even if seems so in the moment. After all, it’s better to have a scar than to be fully burned.

I finally told the Tutor I would be withdrawing my funds and walking away. They naturally played their next card, claiming I couldn’t exit now, and that if I did, my current task would register as incomplete and they wouldn’t be able to return any of the money I had already deposited.

Figuring out that it was a scam all along

The thought of losing everything completely paralysed my rational judgement.

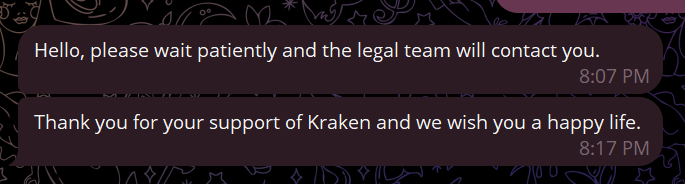

I was already too far in, too financially and emotionally invested. In a desperate attempt to make sense of it all, I texted the Receptionist to ask if I could trust them. They gave me their word that the entire operation was legitimate and definitely not a scam. They even “encouraged” me to ask my friends for help to complete the final task so I could retrieve my money.

The scammer “encouraging” me.

Feeling cornered and overwhelmed, I reached out to a kind contact for help. Deep down, I knew it was wrong to drag other people into this, but I was so consumed by the situation that I blindly followed the scammer’s lead. I went ahead and wired the borrowed money to the Tutor, letting myself believe that this really was the last task – even as my intuition screamed at me to stop, and every fibre of my being told me that this was wrong.

As a result of that transfer, almost instantly, the balance in my Kraken account increased tremendously. For a split second, I felt a sense of relief – not because I was ecstatic to see the huge profit I had just made, but because I just wanted to recoup my investments so far.

The next part played out like clockwork. I was congratulated for completing the task and told that I would be able to retrieve my cash, but not before I forwarded the screenshot as proof of completion. You’d think this was the signal to my exit from the scheme. Boy, was I wrong.

The Tutor suddenly claimed my account was frozen because I’d allegedly executed a trading step incorrectly. When I pressed them for a solution, they hit me with yet another demand. To unfreeze my account, I would need to raise funds for a hedge fund – a sum that just happened to be exactly what I’d deposited for my last task.

At that moment, I realised there was really no way out of this. The entire scheme was a virtual labyrinth designed to keep victims trapped and bleed them dry. As a last resort, I reached out to Kraken’s customer service line – but it only forced me to finally face the bitter truth I’d been trying to stifle for some time: I’d been scammed, and there was no getting my money back.

As if to add insult to injury, the support agent ended our exchange with a cryptic line that sounded almost like a sneer: “Thank you for your support of Kraken, and we wish you a happy life.”

The days following the incident were some of the toughest I’d ever faced in my life. It wasn’t just about coming to terms with the fact that I’d been legitly scammed. It was the weight of knowing I had to repay the money that had been lent to me by people who trusted me.

I went through every emotion imaginable: crying, breaking down, and feeling a kind of pain I’d never experienced before. This wasn’t just about losing money – it was the betrayal of trust, the realisation that people can be so heartless, and the stark truth that scams are all too real.

But after crying my eyes completely dry, I knew I had to pull myself together. Sitting in despair wasn’t going to get me anywhere. I got to work, hustling relentlessly, and thankfully, with my salary just in, I managed to pay back both of these kind souls.

How to look out for a crypto scam

A report by the Malaysia Computer Emergency Response Team (MyCERT) states that in 2024, Malaysians lost a staggering US$12.8 billion (~RM53.88 billion) to scams. The total sum lost by our countrymen makes it clear that there should be more efforts to raise awareness on common scams in Malaysia, and that scams can happen to anyone – the elderly, students, and working professionals.

We can take a page from our neighbour, Singapore, which is said to be the first country in the world to introduce The Protection from Scams Bill, as reported by The Straits Times in November 2024. The bill gives police the power to take control of bank accounts of scam victims, to ensure that they can be protected from themselves in their most vulnerable moments.

It’s also good to practise healthy skepticism, especially when it comes to financial matters. It can be necessary to leave room for doubt at times, and let actions speak for themselves as it carries more weight than just words.

Knowledge is power. Scammers thrive on ignorance and emotional vulnerability. The more you educate yourself on scams, their warning signs, and protective measures, the less likely you are to fall victim to their schemes.

Most scammers build their schemes upon a common modus operandi. They’ll start by attempting to establish trust with their victims, and then lure them into a web of lies. They typically promise higher returns with each investment, share platforms that show a huge profit, come up with excuses when victims “fail” to withdraw their money, and finally, vanish with your money once all is said and done.

Mistakes don’t have to be endings

There’s a saying that goes, “You won’t understand until it happens to you.” Well, I now know this to be true. Before being scammed, I – like most Gen Z and Millennial adults – thought I was too savvy and would never fall for a scam. But falling into traps involving money can truly happen to anyone, especially when it starts off with easy work and promises small returns versus harder-to-believe large sums.

I won’t sugarcoat it. My scam experience was devastating. Looking back, I learned several painful but profound lessons. I was reminded that trust is precious. And because of that, we should never easily give it away – especially to people we barely know.

The incident also taught me to lean into my values and rise above adversity. Mistakes like these aren’t endings, after all – they’re simply steps in the journey of growth. And while growth is never easy, at least I managed to escape the harmful loop of events safely – even if my bank account took a major hit in the process.

If you’ve been scammed in Malaysia or know someone who has, call the National Scam Response Centre (NSRC) at 997, or reach out to your bank’s scam hotline.

For more perspective reads, check out:

Cover image adapted from: TheSmartLocal