Millennials advised to save more, as 40% overspend

It’s not hard to find millennials and zoomers at malls spending their gaji on the latest trends or after-work lepak activities. But it doesn’t always mean that we are spending frivolously or that we overspend what our paycheck allow for. There are many who keep in mind the need to pay bills such as food, petrol, loans and rent, and others who find side hustles to keep up with rising cost of living in cities such as KL.

In a speech given at Kembara Bijak Wang (KBW) 2020, however, Finance Minister Tengku Datuk Seri Zafrul Abdul Aziz cited a survey saying that 40% of Malaysian millennials overspend, while 47% have credit card debts. As an example, he shared how millennials should only be spending on what they need and looking to save RM500/month from their 20s to have RM1 million at 60 years old. But while the calculation is sound, netizens say that the example is not realistic.

Over 40% overspend, while 47% millennials in debt

The speech referenced in recent media reports was from the Finance Minister’s closing remarks for a prize-giving ceremony for KBW 2020, a programme that educates students on financial literacy, on 9th March 2021. In it, he made the statement saying that millennials are spending more than their paychecks allow for, citing statistics from Bank Negara Malaysia that 47% of millennials in Malaysia were high in credit card debt despite their age.

According to statistics by Department of Statistics Malaysia, fresh graduates’ average salary in 2019 was just over RM2,300/month, while the current minimum wage is RM1,200/month, as reported by The Star.

Image credit: Kalibrado

Image credit: Kalibrado

The Finance Minister’s advice to millennials – who have easy access to online shopping and credit usage that might be making it difficult for them to stay within their budgets – is that they should focus on what is needed, and “prioritise purchases, be it a new outfit or PS5”.

He, nonetheless, commended those who have been starting their own small businesses for extra income, and noted that the alternative gig economy allows for millennials to take up jobs as delivery riders or Shopee vendors as a side hustle to “enhance [their] savings”.

Image adapted from: Unsplash | Hannah Sibayan

As a way to think ahead, he advised anyone who wants to be a millionaire to start early in the game by setting aside savings and to invest wisely. He used an example of a 20-year-old with dreams of having RM1 million by 60 years of age, and said that the scenario is possible if they save RM500/month, starting from 20 years old, and invest the money in something that gives them 6% per annum interest.

As an additional note to this point, the Finance Minister also stated that 50% of EPF members have less than RM200,000 accumulated – slightly lower than the average savings of RM240,000 expected of members by the time they reach 55 years of age. 50% of them will have used up their compulsory savings in 5 years, which makes it worth thinking of ways to further save.

Netizens say savings of RM500/month unrealistic

The statistics given by the Finance Minister as a call for Malaysians to think about how they spend their money and save for the future, however, have been called unrealistic by many Malaysians netizens.

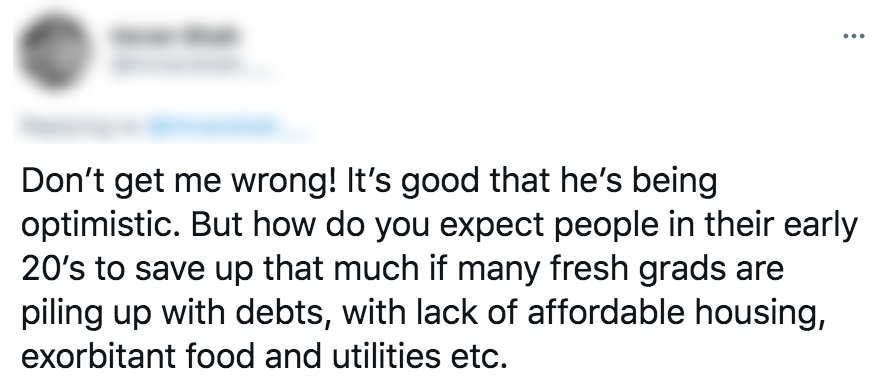

One Twitter user came out to say that savings are hard for anyone in their early 20s, especially fresh grads who are “piling up with debts”. They also said that there is a “lack of affordable housing, [combined with] exorbitant food and utilities [costs]”.

Image adapted from: Twitter

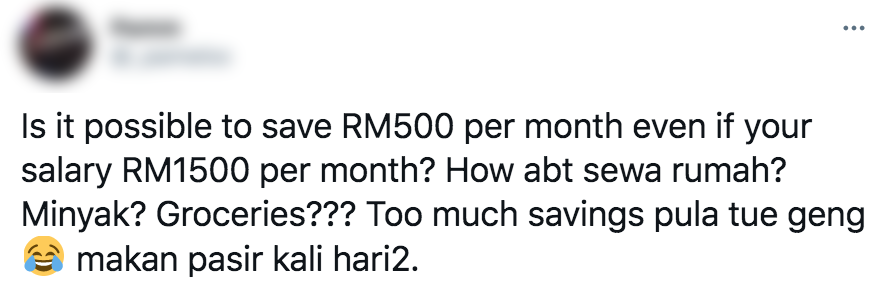

Image adapted from: Twitter

In response to the first netizen’s tweet, another Twitter user tweeted, “Is it possible to save RM500 per month even[,] if your salary [is] RM1,500 per month? How about rent? Petrol? Groceries?”

Image adapted from: Twitter

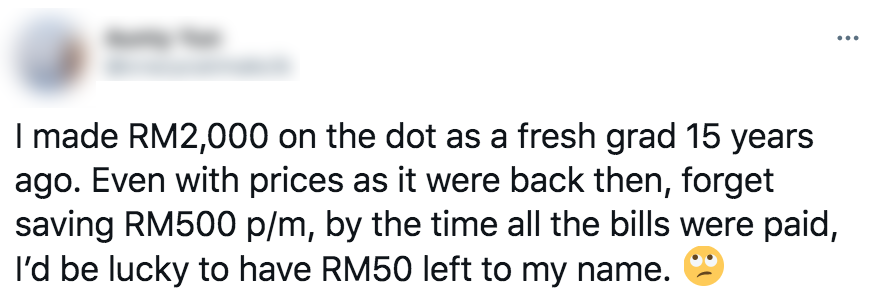

Citing a personal example, another Twitter user tweeted, “I made RM2,000 on the dot as a fresh grad 15 years ago. Even with prices as it were back then, [I had to] forget about saving RM500 per month. By the time all the bills were paid, I’d be lucky to have RM50 left to my name.”

Image adapted from: Twitter

40% of millennials overspend, while 47% have debts

Many of us are trying our best to make ends meet during these tough times – so saving RM500 per month might not be a realistic goal. But saving what we can every month, be it RM5 or RM50, might be a prudent financial move to alleviate financial worries once we’re older.

Read more news here:

- Fresh grads average salary in 2019 was just RM2,370

- Colony CEO offers RM3,000 starting pay for fresh grads

- KL ranked 4th most overworked city in global survey

Cover image adapted from: Malaysia Shopping Mall

Follow The Smart Local Malaysia on Facebook, Twitter, Instagram and Telegram for more stories like this. If you have a story to share, email us at [email protected].